Our focus on the new edited volume, Shaped by the State: Toward a New Political History of the Twentieth Century continues as University of Maryland historian David M.P. Freund explores economic policy notably the government’s role as “monetary sovereign.” Freund recently discussed his research and the value of applying heterodox economic analysis to the study of American history in a podcast for “Money on the Left” which is mentioned below as well. You can see The Metropole’s overview of Shaped by the State here along with our interview with Andrew Kahrl and his exploration of the property assessments and Black taxpayers here.

By David M.P. Freund

At a social function several years ago I was introduced to a colleague, who is a rather prominent historian of the United States, and he asked me about my research. When I answered that I was writing a book about money, banking, and financial policy he replied—without missing a beat—that the topic “makes my eyes glaze over” and then, a minute or so later, turned away to talk with someone else. No, it wasn’t polite, but I’ve always appreciated his unfiltered response, which was sort of a caricature of the reaction that I get from a lot of people, including academics, when I raise the subject. And so while I recognize that these topics might not seem scintillating at first glance, they demand our attention and some questioning of economic orthodoxies. Testing the conventional wisdom about finance and its history has the potential to really shake things up.

My chapter in Shaped by the State argues that if we are to reckon fully with public policy’s impacts on the American economy and the built environment, we need to scrutinize common assumptions about money. In simplest terms, I explore how federal power shapes people’s access to financial resources. Who gets to borrow funds for the purpose of producing or consuming and how do state institutions help determine those outcomes? What is the federal government’s relationship to the markets for money and debt?

To be clear, this is not a study of the federal budget and government spending priorities; this is not about “fiscal policy,” traditionally conceived (although it has important implications for that subject). Instead, it concerns the state’s role, as a monetary sovereign,[1] in both the creation and distribution of money and debt, a different but no less important source of unequal development and persistent inequality in modern America.

I began exploring the government’s hand in the making of inequality in a book about race and federal housing policy called Colored Property (Chicago, 2007) and so this new project has distinctly metropolitan origins. In Colored Property, I argue that the federal government created a new kind of discriminatory market for housing in the 1930s, one that financed construction and sales in new ways by reinventing and subsidizing mortgage lending. Of equal importance, the new federal presence popularized the mythical narrative that suburban growth and the meteoric rise of white homeownership rates were strictly “free market” outcomes. The federal state helped to create wealth in housing and structure racially the market that distributed that wealth, while simultaneously concealing its foundational contributions to both of these processes.

I began exploring the government’s hand in the making of inequality in a book about race and federal housing policy called Colored Property (Chicago, 2007) and so this new project has distinctly metropolitan origins. In Colored Property, I argue that the federal government created a new kind of discriminatory market for housing in the 1930s, one that financed construction and sales in new ways by reinventing and subsidizing mortgage lending. Of equal importance, the new federal presence popularized the mythical narrative that suburban growth and the meteoric rise of white homeownership rates were strictly “free market” outcomes. The federal state helped to create wealth in housing and structure racially the market that distributed that wealth, while simultaneously concealing its foundational contributions to both of these processes.

While writing that book I was puzzled by scholars’ characterizations of money and debt, because they seemed to be at odds with the documentary record of the state’s growing influence. And I soon learned that these characterizations are faithful to conventional, textbook treatments of finance. Standard economic theory portrays money as a commodity-like token that, by representing value, facilitates extensive barter-like networks of exchange (it has other functions as well). Debt, by contrast, is portrayed as a contractual arrangement to “borrow” someone else’s money now, in exchange for a promise to “repay” that money later, plus an accompanying charge for the privilege (i.e., interest). In other words, money enables you to buy stuff whereas debt helps you make special arrangements for using other people’s money to buy stuff. According to this logic, you cannot “make a purchase” directly with a debt instrument. And money is not debt.

Of equal importance—and again curious to me, in light of the documentary trail—standard theory treats money and debt as “exogenous” to economic growth. By this economists mean that financial instruments are useful to facilitate exchange but not, in the final analysis, essential to the growth process, because exchange would theoretically continue without them (and would naturally lead the economy towards full employment). They argue that “money is only a mechanism”—to cite a forerunner of modern macroeconomic theory—“by which [a] gigantic system of barter is carried out.”[2] In this telling, economic growth is a “real sector” phenomenon, rooted in the use of “factors of production” and driven by individual choices about exchange, while the financial sector helps people arrange their wealth and make strategic decisions about spending. Finance helps people exchange efficiently.

Two things about this conventional wisdom should concern us. Again, it does not line up comfortably with the historical record. Consider the mortgage revolution. Beginning in the 1930s and for decades thereafter, federal insurance programs created valuable financial assets (home mortgages), which in turn created new wealth in housing. The exercise of state power built new homes and enabled people to gain equity in private property by sanctioning, insuring, and facilitating the circulation of debt. And this creation of new financial instruments produced wealth that the “real” sector, on its own, would not have otherwise produced. Indeed, federal officials struggled to convince lenders and borrowers alike to experiment with a new and untested long-term mortgage. The state literally created a market.

Second, and crucial to understanding debates about the sources of inequality, the conventional narrative about finance and free markets performed—and continues to perform—important political work. In the case of mortgage lending, it enabled contemporaries (public officials, bankers, homebuyers) and subsequent observers (economists and historians) to radically misrepresent the federal government’s stamp on the post-war housing market and its racial geography. If one agrees with the orthodox premise that the financial sector cannot be a motor of wealth creation—that it, instead, merely “unleashes” generative powers already latent in the “real” economy—then one can earnestly believe that the government’s creation of debt instruments is not economically “productive” or wealth-producing. By this logic, federal mortgage programs did not create and distribute wealth in housing or, for that matter, a host of related sectors. Rather, the story goes, new state capacity merely “freed up” the private sector so that it could perform this important work.

It was this apparent distortion of the state’s record that sent me down a rabbit hole of examining financial policy in light of monetary theory. The result is a series of essays and a book-in-progress called State Money: Economic Growth and Market Mythologies in Modern America, in which I take a deep dive into the mechanics of finance and debates over the nature of money. Both of these subjects are sampled in my “State Building” chapter in Shaped By the State.

The big take-aways are pretty straight-forward. First—and this is regularly met by blank stares—the orthodox economic models informing most historical scholarship on banking, debt, and financial policy are grounded in a story about finance that does not appear to have happened. We cannot document the “origins story” about money and credit that undergirds basic textbook economics—the claim that money first emerged in ancient societies to replace barter (which was inconvenient and limited people’s options) and that credit forms developed later, to further facilitate this barter-like exchange. Nor can we document that money forms, to this day, necessarily operate differently from credit. A vast heterodox scholarship in economics, sociology, history, and anthropology has shown instead that our conventional monetary instruments have their origin in debt instruments: basically in IOUs, or “promises to pay.” It demonstrates that monetary creation, which is performed both by banks and monetary sovereigns, represents the issuing of debt. And it demonstrates that the issuing of debt is essential to productive processes, to economic growth. Orthodox economists have consistently refused to address this critique, however, and that should trouble us. Historians should be skeptical of an economic conceptual universe that is grounded in a fictional account of money’s history.

The second takeaway relates to a more familiar topic—the quarter century of financial reform initiated with the Federal Reserve Act of 1913 and culminating with the Emergency Banking Act of 1935—and illustrates the stakes in what might otherwise seem an arcane debate among monetary theorists. By accepting economic orthodoxy about money and debt, histories of financial policy regularly mask the federal state’s assumption of important new powers over the American economy. For example, these early 20th century reforms consolidated and vastly enhanced the U.S. government’s authority to issue a sovereign currency, to ensure the value of bank-issued deposits, and to support materially new markets for debt spending (through a host of “selective credit programs”). I have not encountered a scholar—in person or in print—who disagrees about these fundamental changes in state capacity. But the consensus view is that these reforms had no impact on the dynamics of the growth process—that is, on the market mechanisms which drive the economy’s production of real wealth (in things). These reforms helped to unleash real sector productive capacities, the story goes, but were neither essential to nor constitutive of the growth process.

Now step back and consider this familiar history of reform in light of the heterodox work on money and debt. If creating monetary instruments and issuing debt are economically productive—and I agree with generations of writers who argue this point—then the U.S. government gained unprecedented authority in the early 20th century to drive economic growth and dictate the allocation of its benefits. The federal government’s new stake in the currency and in the mechanics of American finance—I discuss specifics in the chapter—gave the state unprecedented power to shape the marketplace.[3]

Note that the heterodox view of money also challenges profoundly conventional accounts of fiscal policy: namely, the claim that the U.S. Treasury collects private revenues (by taxing, charging fees, and borrowing) and then recirculates them when it spends. Money’s well-documented history demonstrates, in sharp contrast, that spending by a monetary sovereign is different in kind from spending by the private sector. And it shows that money creation by a monetary sovereign (which is what the U.S. Treasury does, with help from the Fed, when it spends) is different in kind from money creation by the banking system (which is what banks do when they create checking deposits). When the U.S. government spends, it adds net financial assets to the economy. Neither private investment nor private (bank) money creation have such power.

I elaborate on this point a bit in the “Money on the Left” podcast linked here and above. But the best introductions are the writings of L. Randall Wray, Stephanie Kelton, and other scholars associated with Modern Monetary Theory. Kelton’s contributions have been especially visible of late (in Bloomberg and The New York Times, for example) in part because of her work with Congress and with Bernie Sanders’ presidential campaigns.

I elaborate on this point a bit in the “Money on the Left” podcast linked here and above. But the best introductions are the writings of L. Randall Wray, Stephanie Kelton, and other scholars associated with Modern Monetary Theory. Kelton’s contributions have been especially visible of late (in Bloomberg and The New York Times, for example) in part because of her work with Congress and with Bernie Sanders’ presidential campaigns.

In short, money matters in ways that conventional renderings of finance too often ignore. Money is a form of debt and debt obligations both enable and structure economic development. For these reasons, public policy’s history of shaping creditor-debtor relationships deserves prominent place in our study of the American past and present.

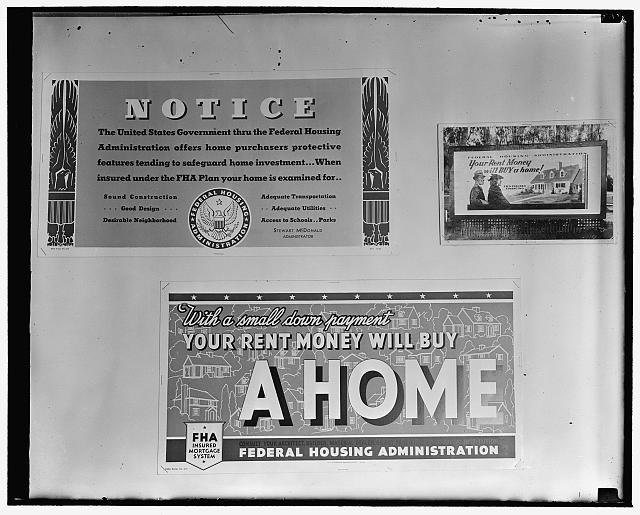

Featured image (at top): FHA posters, Ewing and Harris, 1937-1938, Prints and Photographs Division, Library of Congress

David M.P. Freund, associate professor of history at the University of Maryland, is the author of Colored Property: State Policy and White Racial Politics in Suburban American (University of Chicago Press, 2007) which among other awards received the Kenneth Jackson Book Award from the Urban History Association in 2007. He is currently completing State Money: Economic Growth and Market Mythologies in Modern America, a history of financial policy and free market ideology in the modern United States.

[1] A government that monopolizes currency issue, denominated in the money of account, in this case the U.S. dollar.

[2] Alfred Marshall, Official Papers of Alfred Marshall, ed. by J.M. Keynes (Macmillan, 1926), 115. In a standard textbook account published in 1973, Paul Samuelson explained that “if we strip exchange down to its barest essentials and peel off the obscuring layer of money, we find that trade between individuals or nations largely boils down to barter.” Paul A. Samuelson, Economics (McGraw Hill, 9th edition, 1973), 55. As later editions explained, “societies that traded extensively simply could not overcome the overwhelming handicaps of barter.” Samuelson and William D. Norhous, Economics (McGraw-Hill, 18th edition, 2005), 511. Joseph Stiglitz and Bruce Greenwald agreed in 2003 that money is “hardly essential,” but rather “a convenient way of keeping score” and “of ascertaining who has claims on resources, . . . [T]hat is all. . ..” Joseph Stiglitz and Bruce Greenwald, Towards a New Paradigm in Monetary Economics (Cambridge, 2003), 293-4. For introductions to the evolution—and distortion—of Keynesian assumptions regarding money and risk, see J. Barkley Rosser, Jr., “Uncertainty and expectations,” and L. Randall Wray, “Money and inflation,” in Richard P.F. Holt and Steven Pressman, A New Guide to Post Keynesian Economics (Routledge, 2001) 52-64, 79-91.

[3] On earlier periods of reform by monetary sovereigns, essential reading includes L. Randall Wray, Money and Credit in Capitalist Economies (Edward Elgar, 1990), chp. 2; Geoffrey Ingham, The Nature of Money (Polity, 2004), chps. 5-6; Christine Desan, Making Money: Coin, Currency, and the Coming of Capitalism (Oxford, 2014); and Desan, “Money as a Constitutional Medium,” Law and Political Economy (May 14, 2019) https://lpeblog.org/2019/05/14/all-debts-public-and-private/?fbclid=IwAR1DAijmSL6PeZSKhEcSqkSUpDEuKfPtivp8FGN293O5UtP5zLl86JYEt-8

2 thoughts on “Money Matters”